44 calculating tax math worksheets

Money Worksheets With Tax | Teachers Pay Teachers Worksheets and Task Cards Add Subtract Next Dollar Up and Calculate Sales Tax by Carol Bell - Saved By A Bell 19 $27.25 $21.75 Bundle Zip SHOPPING MADE FUN and EASY! This product simulates a real shopping experience for kids who are working on functional math skills using super engaging TASK CARDS and NO PREP! How Your Tax Is Calculated: Tax Table and Tax Computation ... The IRS calculated this from the start of the bracket times the rate of the bracket minus the amount of tax actually owed by moving through the lower brackets or in this case $80,250 * 0.22 - $9,234.9 = $8,420.10. So $33,000 minus $8,420 = $24,580 for your tax owed.

PDF Sales Tax Practice Worksheet - MATH IN DEMAND Worksheet Practice Score (__/__) Directions: Solve the following problems on sales tax. Make sure to bubble in your answers below on each page so that you can check your work. Show all of your work! 2 3 4 6 7 1If a table costs $45 and the sales tax is 5%, what is the sales tax? 0.05 Sales Tax = $2.25

Calculating tax math worksheets

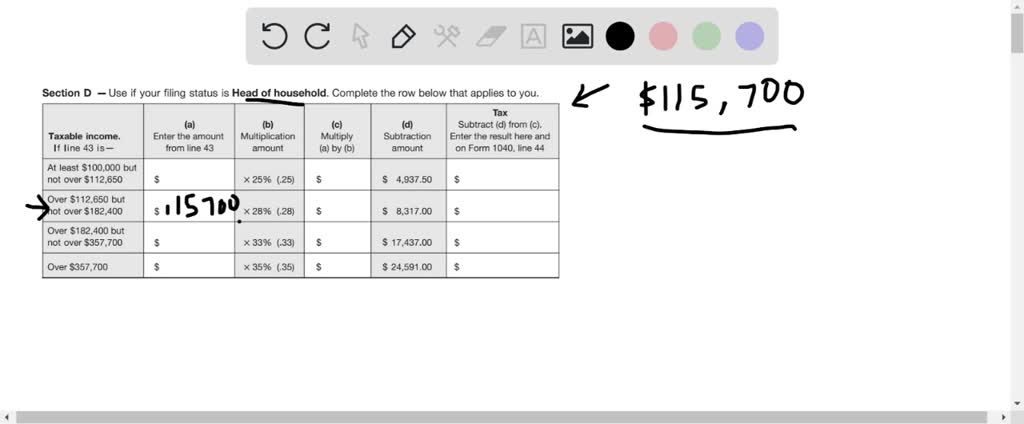

PDF Worksheet: Calculating Marginal vs. Average Taxes ... Worksheet: Calculating Marginal vs. Average Taxes Worksheet, with answers (Teacher Copy) Federal Tax Brackets and Rates in 2011 for Single Persons From: To: Taxed at Marginal Rate of: $0 $8,500 10% $8,501 $34,500 15% $34,501 $83,600 25% $83,601 $174,400 28% $174,401 $379,150 33% $379,151+ 35% How to Solve Percent Problems? (+FREE ... - Effortless Math How to Find Discount, Tax, and Tip; ... Exercises for Calculating Percent Problems ... 3rd Grade WY-TOPP Math Worksheets: FREE & Printable ... PDF Tribal Taxes Math Worksheet - Oregon.gov Tribal Taxes Math Worksheet (Continued) Step 4 Use the table and/or chart above to write a piecewise function to calculate actual federal income taxes owed for a given income. x = Income in dollars T(x) = Federal income tax owed (by a single taxpayer) Step 5 Use your piecewise function to calculate how much John owes in federal income taxes.

Calculating tax math worksheets. Calculating Sales Tax Ontario Worksheets & Teaching ... Math Moji Digital Calculating Sales Tax Online Game 2020 Ontario Math Curriculum. by. Dr SillyPants Classroom Resources. 3. $4.50. Zip. Google Apps™. Internet Activities. The Math Moji Digital Series is an online, interactive game series that students can play independently in the classroom or as part of at home study. Calculating Tax- purchase worksheet ID: 1239539 Language: English School subject: Math Grade/level: Special Education Age: 11+ Main content: Making purchases, calculating tax Other contents: addition Add to my workbooks (11) Download file pdf Embed in my website or blog Add to Google Classroom Sales Tax - FREE Math Lessons & Math Worksheets from Math ... Sales tax is a tax on goods and services purchased and is normally a certain percentage added to the buyer's cost. Solution: 2.36 ÷ $32.00 = 0.0735. Sales tax was charged by the department store at a rate of 7.375%. Answer: Mr. Smith should pay the department store $32.00 plus $2.36 in sales tax for a total bill of $34.36. Calculating Total Cost after Sales Tax worksheet Close. Live worksheets > English > Math > Percentage > Calculating Total Cost after Sales Tax. Calculating Total Cost after Sales Tax. Finding Sales Tax and Total Cost after it is applied. ID: 839531. Language: English. School subject: Math. Grade/level: Grade 5. Age: 7-15.

Applying Taxes and Discounts Using ... - WorksheetWorks.com Create a worksheet: Find the price of an item after tax and discount. Applying Taxes and Discounts Using Percentages. Find the price of an item after tax and discount. These problems ask students to find the final price of various items after discounts and taxes are applied. ... Math.com Calculators and Tools Free math lessons and math homework help from basic math to algebra, geometry and beyond. Students, teachers, parents, and everyone can find solutions to their math problems instantly. Calculating Tax Worksheet Teaching Resources | Teachers ... This resource is great for students who need practice calculating tax, gratuity and discounts from word problems. Problems include scenarios where students are given a total amount of a bill, tax and gratuity percent, and students need to calculate the final amount. Students should know which to calculate first, second, and so on… Trapezoid Bases, Legs, Angles and Area, The Rules and Formulas A trapezoid is a quadrilateral with one pair of parallel lines. Bases - The two parallel lines are called the bases.. The Legs - The two non parallel lines are the legs.

Taxes Lesson Plans, Income Tax Worksheets, Teaching Activities A basic worksheet to help teach young students the concept of paying taxes while practicing basic math. SALES TAX Discount and Sales Tax Lesson Plan Students learn about sales tax and discounts. Lesson includes changing percents and calculating total cost. Includes a teaching lesson plan, lesson, and worksheet. Sales Tax Introduction (Level 1) How to calculate taxes and discounts | Basic Concept ... There are two types of taxes: direct tax and indirect tax. In this lesson, we will study the tax computation when the selling price or price before tax is given. We calculate tax on a product by multiplying the tax rate with the product's net selling price. Tax amount = \($(S.P. \times \dfrac{Tax\ rate}{100})\) Finding the rate of a tax or commission: Worksheets Finding the rate of a tax or commission: Worksheets. Welcome to the Finding Percents and Percent Equations Worksheets section at Tutorialspoint.com. On this page, you will find worksheets on finding a percentage of a whole number, finding a percentage of a whole number without a calculator: basic & advanced, applying the percent equation ... PDF Tax and Tip (Percent) Word Problems Tax and Tip (Percent) Word Problems 1. A bicycle is on sale for $189.50. The sales tax rate is 5%. What is the total price? 2. Rosa and her friends are eating out for dinner. The bill was $45.80. They want to leave a 20% tip. How much should they leave for tip? 3. Rick bought 3 shirts for $18 each, 2 pair of socks for $3.99 a pair, and a pair ...

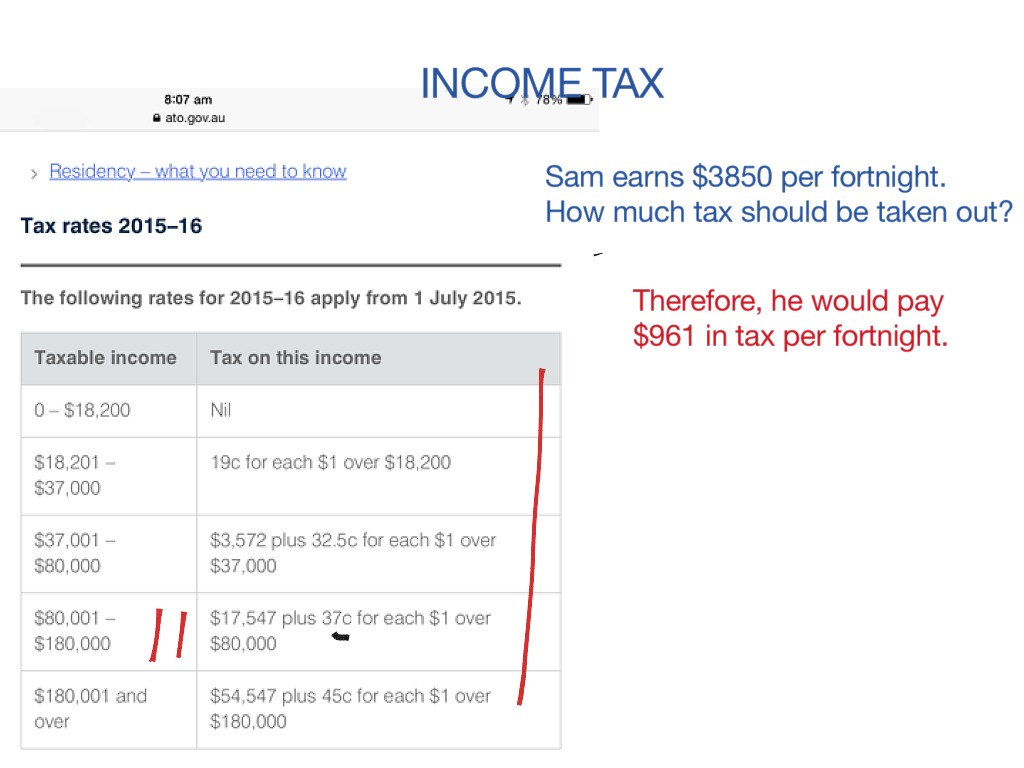

Income Tax worksheet ID: 1342388 Language: English School subject: Math Grade/level: Secondary Age: 11-18 Main content: Income Tax Other contents: Percentages Add to my workbooks (5) Download file pdf Embed in my website or blog Add to Google Classroom

Calculating Sales Tax | Worksheet | Education.com Catered to fifth-grade students, this math worksheet shows kids the steps to find the amount something costs with tax. This process uses decimal numbers, rounding, and division. Students practice what they learn in both straightforward calculations and in word problems. Download Free Worksheet See in a set (11) View answers Add to collection

Quiz & Worksheet - Calculating Taxes & Discounts | Study.com Taxes & Discounts: Calculations & Examples. Worksheet. 1. Mary buys a pair of jeans for $24.99, a skirt for $32.99 and a pair of shoes for $49.99. She has a coupon for 15% off the most expensive ...

Quiz & Worksheet - How to Calculate Property Taxes | Study.com Worksheet 1. A house has an assessed value of $250,000. The local government has a tax rate of $75 per $1,000 for calculating the property tax. What is the property tax? $20,000 $18,750 $21,570...

Calculating Percentage Increase And Decrease - Math Goodies Learn About Calculating Percent Increase And Decrease With The Following Examples And Interactive Exercises. Example 1: Ann works in a supermarket for $10.00 per hour. If her pay is increased to $12.00, then what is her percent increase in pay?

Probability, Statistics, and Data Analysis Activities for ... Extra math worksheets can also be found online and used to practice math skills at home, helping you to better understand class materials and even get a head start on upcoming assignments. Use these resources to your advantage and make sure to get the help of a parent or teacher if you’re struggling with probability, statistics, or data ...

PDF Discount, Tax and Tip - Effortless Math Math Worksheets Name: _____ Date: _____ … So Much More Online! Please visit: EffortlessMath.com Discount, Tax and Tip Find the selling price of each item.

Income Tax Worksheets Teaching ... - Teachers Pay Teachers Taxes: Gross & Net Income Budget Calculation Worksheet by Elena Teixeira $1.75 Word Document File This worksheet will take your students through a step-by-step simulation of calculating their net income from a gross income starting point.

Tax Worksheets Teaching Resources | Teachers Pay Teachers Reinforce calculating tax and tip and the total bill with this nine question worksheet. Students are given ample space to show their work on the real-world problems. The problems increase in difficulty as the students navigate through the worksheet. Save 20% by purchasing this resource in one of my related bundles.

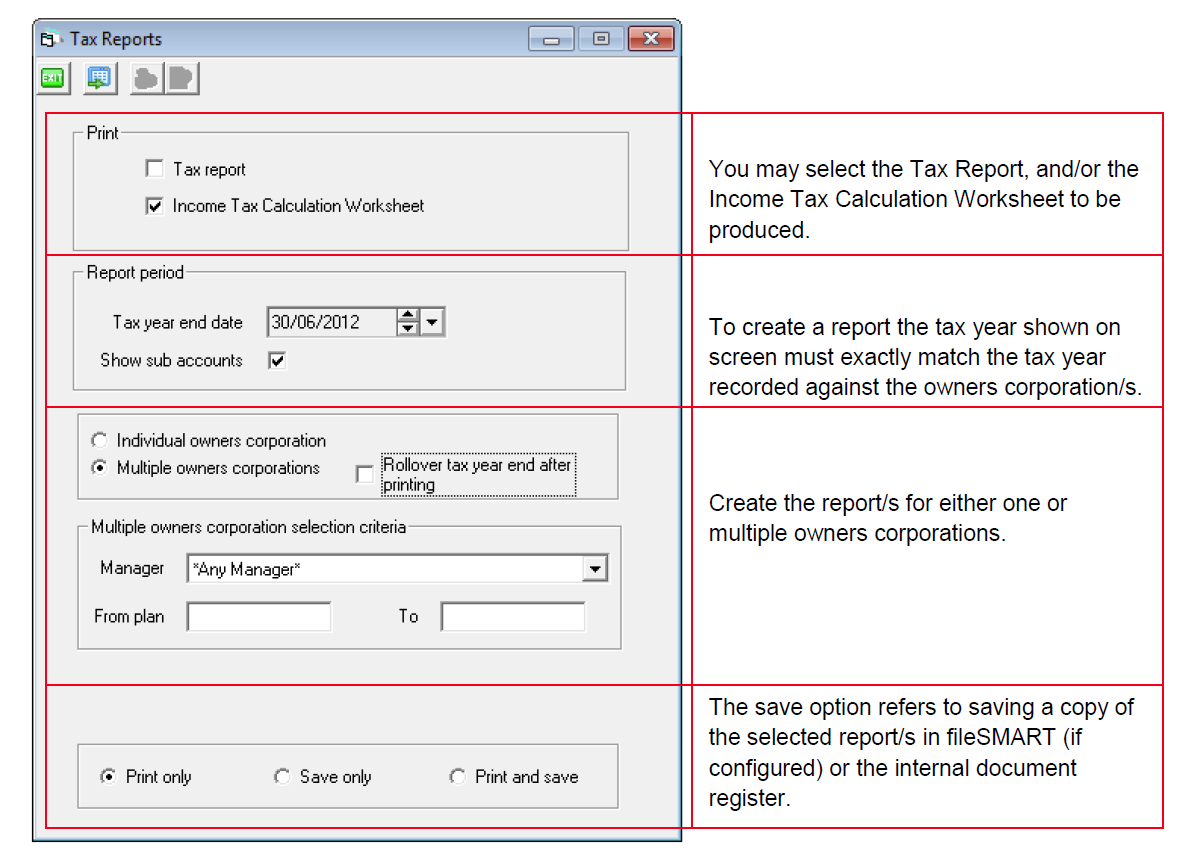

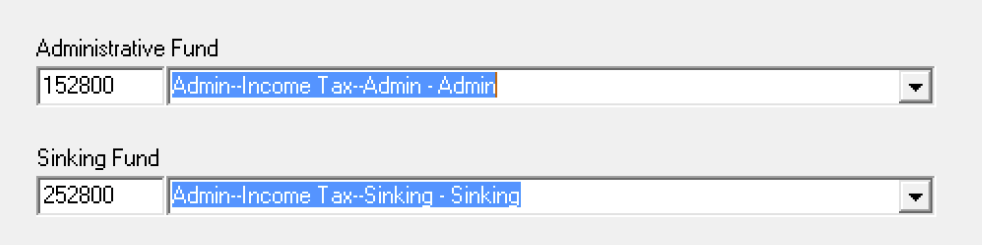

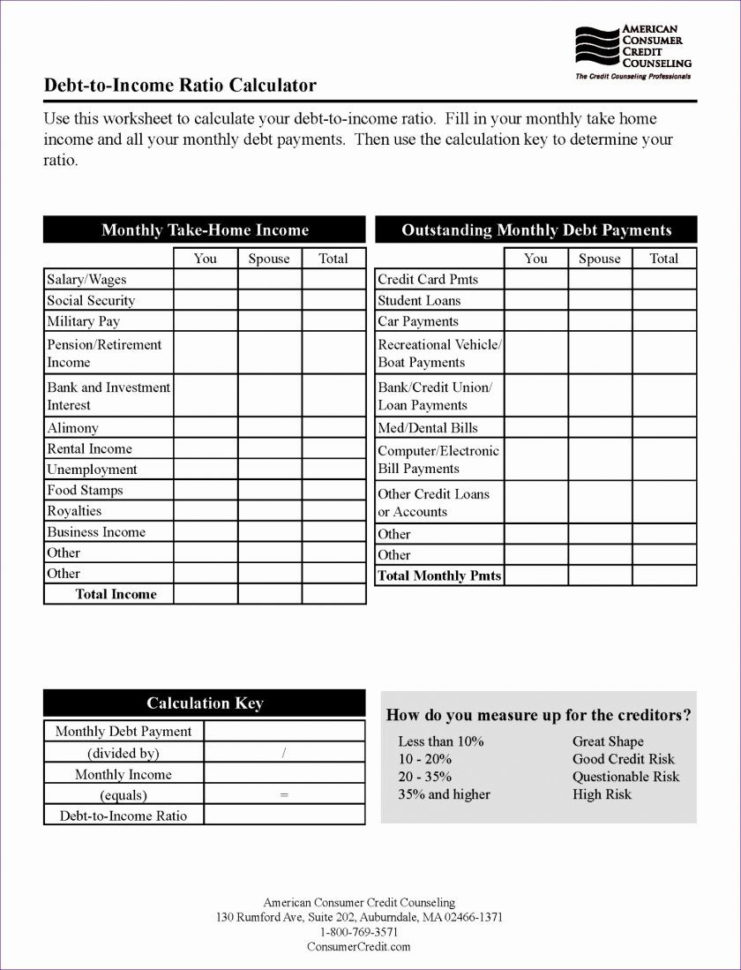

PDF Lesson 3 v2 - TreasuryDirect calculate tax rates (percents) and the dollar amount of taxes. 7. read and understand tax tables. Mathematics Concepts computation and application of percents and decimals, using and applying data in tables, reasoning and problem solving with multi- step problems Personal Finance Concepts income, saving, taxes, gross income, net income

Seventh Grade / Calculating Sales & Income Taxes 7.13 Personal financial literacy. The student applies mathematical process standards to develop an economic way of thinking and problem solving useful in one's life as a knowledgeable consumer and investor. The student is expected to: (A) calculate the sales tax for a given purchase and calculate income tax for earned wages.

Calculating a Sales Tax Lesson Plan, Worksheet, Classroom ... Lesson - Calculating Sales Tax Lesson (see below for printable lesson). Lesson Excerpt: Many states in the United States have a sales tax. How can we calculate a sales tax? First, we need to think about what a sales tax actually is. A sales tax is an extra amount of money beyond the original price.

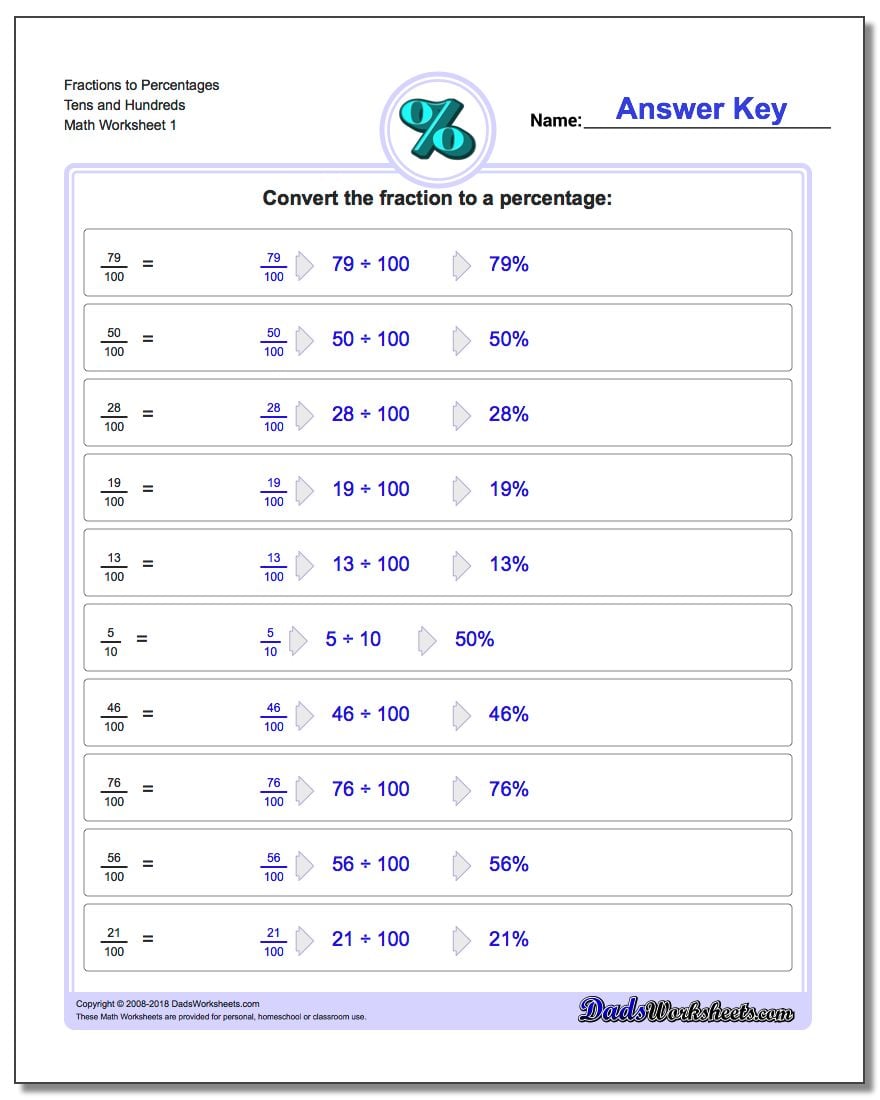

Calculating Percentages | How?, Four Ways, Increase, Decrease You can practice calculating percentages by first finding 1% (and/ or finding 10%) and then multiplying to get your final answer using this Calculating Percentages in Two Steps Worksheet. There are also more percentage worksheets here too.

Texas Essential Knowledge and Skills (TEKS) 7th Grade Math ... 7th Grade Math. Topics: Fraction Operations, Exponents, Factors And Fractions, Using Integers, Rational And Irrational Numbers, The Pythagorean Theorem, Nonlinear Functions And Set Theory. Printable worksheets shared to Google Classroom. Texas Essential Knowledge and Skills (TEKS).

PDF Sales Tax and Discount Worksheet - psd202.org Tax: A tax on sales that is paid to the retailer. You need to add the sales tax to the price of the item to find the total amount paid for the item. Procedure: 1.The rate is usually given as a percent. 2.To find the tax, multiply the rate (as a decimal) by the original price. 3.To find the total cost, add the tax to the original price.

Percents Worksheets - Math-Drills Welcome to the Percents math worksheet page where we are 100% committed to providing excellent math worksheets. This page includes Percents worksheets including calculating percentages of a number, percentage rates, and original amounts and percentage increase and decrease worksheets.. As you probably know, percents are a special kind of decimal.

Adding Taxes Using Percentages - WorksheetWorks.com WorksheetWorks.com is an online resource used every day by thousands of teachers, students and parents. We hope that you find exactly what you need for your home or classroom!

/Percentage-Worksheet-6-57c488275f9b5855e5ce3b6c.jpg)

0 Response to "44 calculating tax math worksheets"

Post a Comment